Deltos Finance Blog

Need more information? Make sure you get the right finance advice.

Call us today on 1300 435 050 or email info@deltosfinance.com.au.

Pros and Cons of Buying Your First Home While You Rent

These days, first-time home buyers are increasingly exploring innovative strategies to enter the real estate game. One such approach gaining traction is buying your first home while continuing to rent. This strategy, often called “rentvesting,” offers an investment opportunity and lifestyle flexibility. But is it the right move for you? Let us help you decide […]

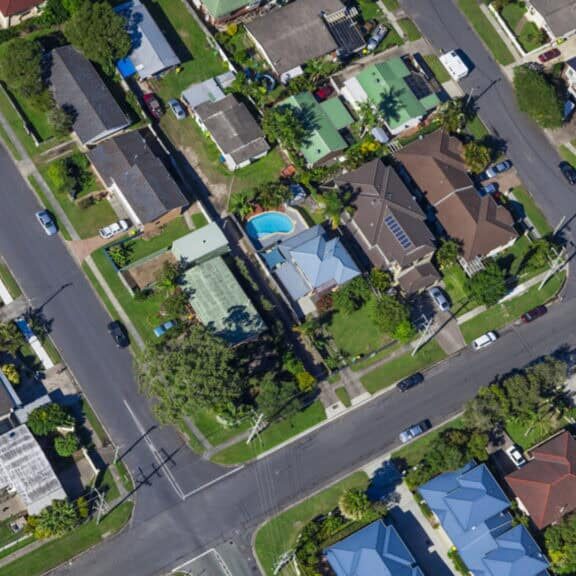

The Different Types of Property: Which One is Right For You?

Buying a property is more than a big-ticket purchase—it’s an investment and a lifestyle choice. So, it pays to consider various factors when finding the right property. Do you prefer a four-bedroom home in the suburbs, a townhouse in the inner city, or an apartment in the CBD? How about a fixer-upper? So, before you […]

A Comprehensive Guide to Buying Your Second Property

Over two million Australians own a second property. Some do it to invest in real estate and increase their wealth, while others simply want to improve their lifestyle with a holiday home. Whether you share the same sentiment or not, purchasing a second home is a huge decision not to be taken lightly. Continue reading […]

Bridging the Gap: Bridging Loans for Property Development

In property investment, timing is everything. Whether you’re eyeing a prime development opportunity or planning to flip houses to upgrade your portfolio, the ability to move quickly can make all the difference. This is where bridging loans may come into play. They offer a fast, flexible financing solution to bridge your financial gap between property […]

Maximising Your Local Mortgage Broker Relationship

Whether buying your first or second home or investing in multiple properties, having a trusted local mortgage broker by your side can make all the difference. The right financial guidance and local insights can point you in the right direction and make your real estate decisions pay off. You can get better results if you […]

Buying a Holiday House: Holiday Let vs Buy-to-Let

It is incredibly enticing to escape to a cosy beachside retreat on weekends or stay in a charming mountain cabin during the holidays. Owning a holiday house is a dream for many Australians; it can also be a savvy investment strategy. However, deciding whether to use your vacation home as a holiday let or a […]

Is Buying a Second Home Right for You?

The idea of owning a second home can be incredibly appealing. It could be a holiday house or an investment property that can generate additional income. But is buying a second home the right decision for you? Let’s explore the key considerations and steps involved in purchasing a second property in Australia. Top Reasons for […]

How to Use Equity to Buy Another Property

As a homeowner, you’re sitting on a valuable asset that can do more than provide a roof over your head. Your property’s equity can be a powerful financial instrument to help you buy a second home or expand your real estate portfolio. So, whether you’re dreaming of a holiday home by the beach near Carlton […]

What to Know About the Home Loan Approval Process

Understanding the home loan approval process and knowing what to do at each stage can make it less intimidating. Today we’ll guide you through the stages, including what to do before lodging your application, when to apply, important considerations, and the support and tools available to make the process smoother. Before You Apply: What You […]

Cash-Out Refinancing: Tapping into Home Equity

As a homeowner in Australia, you may have built up significant equity in your property over the years. But did you know you can tap into this equity to access cash for various financial needs? This is where cash-out refinancing comes into play. In this article, let’s explore what cash-out refinancing is, how it works, […]